Stock Quotations and their meaning

When you wish to invest in stocks, it is very important to select the right stock after thorough research both on technical and fundamental front. Technical analysis helps in understanding the price movement of the stock on an hourly, daily, weekly and monthly basis and fundamental analysis on the other hand helps to know the financial health of the company through various ratios such as Net Profit Margin, ROA, ROE, EPS, PE, etc. Due to advanced online trading platforms, it is easy to buy and sell shares using mobile app these days and one should know about stock market quotes in the first place before investing. One can easily learn about the meanings of share market quotes or can get guidance from research experts to know in detail about the financial status of a company. Let us know how to read a stock quote in this article.

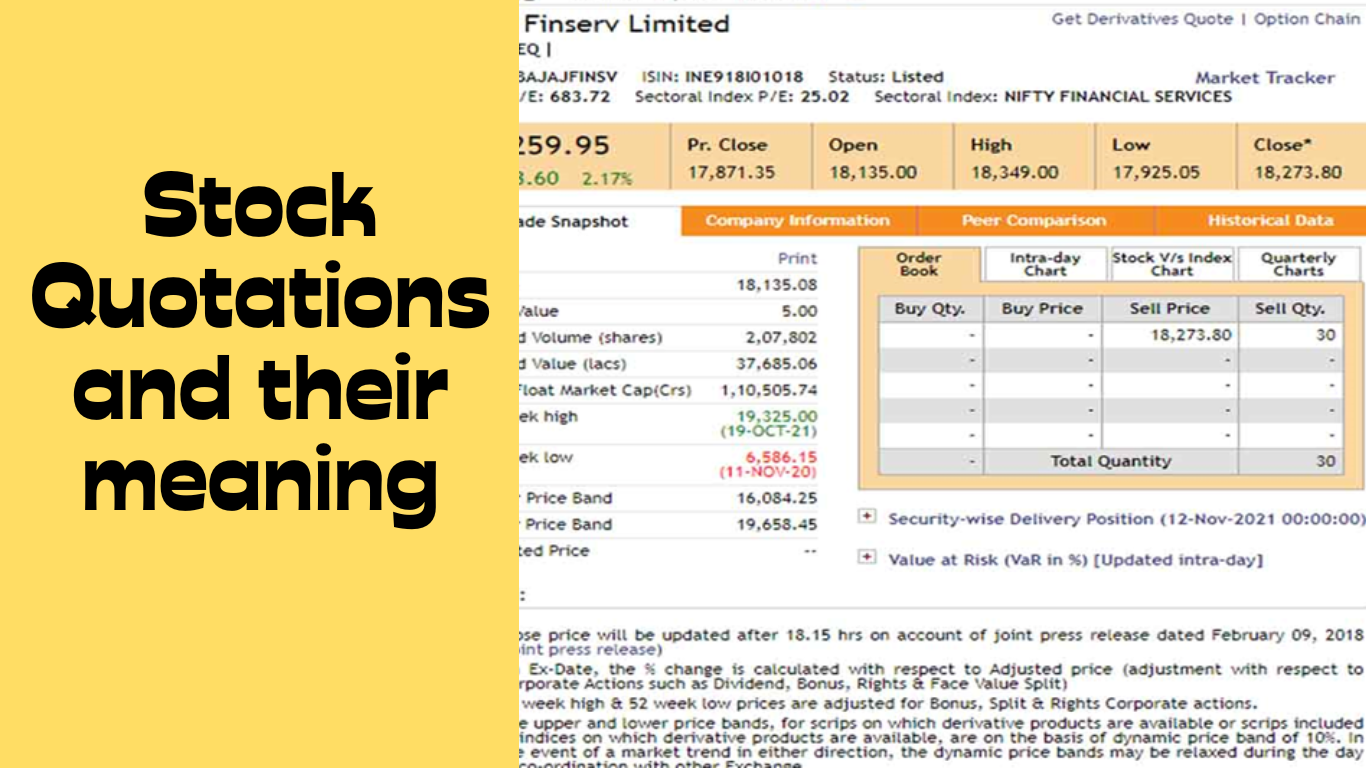

Stock Market Quotes

Stock market quotes are used by the investor to make trading and investing decisions

The stock market has over 500 stocks, and each has its own symbol and price. These are called stock quotes.

When we look at stock market news on a television channel or a computer screen, we get to see several letters and numbers. Those are stock quotes.

The importance of stock quotes

For an investor, it’s very important to be able to read stock market quotes. This is because a stock market investor needs to know the stock price and also historical trends. Investors look to buy a stock when it is at a price that makes it an attractive investment. A stock quote gives you the necessary information required to make an informed purchasing decision.

How to read stock quotes

Now that we have seen what is a stock quote, we will take a look at how to read stock quotes. Here are the elements of a stock quote.

Company symbol: When we look at stock market quotes, it is first important to understand the meaning of STOCK SYMBOL. When a company is listed on an exchange, it is given a unique code or symbol. The stock symbol enables investors to tell at a glance the name of the company and its price. Sometimes the symbol may contain the full name of the company. In case the name is too big, it may be just a few letters or numbers. When you are searching for a stock on the website of the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE), you can use the stock symbol to find out information about price. Stock market quotes are available online, on business news channels and business newspapers.

Stock price: This is the price an investor will pay for a single share of the company. The stock price changes almost every second when the markets are open. When the markets are closed for trading, it stays the same.

Open: This refers to the price at which a stock trades when an exchange opens.

Prev Close: This refers to the price at which the stock closed yesterday or at the end of the previous day’s trading. It is important to note that stocks do not open at the same prices they closed the day before because buying and selling may happen after trading hours.

High/low: During market hours, share prices keep changing as trading takes place. When a stock is bought, the price goes up; when a stock is sold, the price goes down. So the share price keeps changing. The stock quote mentions the highest and lowest prices the share has reached during the day. If stock prices keep going up, the highs would keep climbing as well. If the price keeps going down, the low will keep falling too. After the market closes, one can get an idea of how volatile the stock was from the difference between the highest and lowest price.

Net change: This indicates whether a stock is increasing or decreasing in value and how much its price has changed. The net change is indicated both in absolute and percentage terms. The absolute change is arrived at by subtracting the day’s price from the previous closing price. This figure is then divided by the previous closing price and multiplied by 100 to get the percentage change. If the change is positive, it indicates that the stock price has gone up from the previous day’s closing. When the net change is positive, the stock quote appears in green; when it is negative, it is in red.

Volume: All shares listed on an exchange may not be traded every day. The number of shares traded will depend on the demand for the stock. The volume figure in share market quotes shows how many stocks have been bought and sold. If the trading volume is high, the stock price may change substantially.

52-week high low: This shows the highest and lowest price of the stock in one year or 52 weeks. This helps the investor understand how stock prices have fared over a broader time period.

It is important for an investor to know how to read a stock quote so that he can make proper investing decisions.

Historical Data:

Using this, the price of stock on a daily, weekly and monthly basis can be known. Past performance of the stock should be known to understand the consistency in performance of the stock.

Peer comparison:

This gives a complete picture of the stock in terms of the company’s fundamentals, corporate action details, VaR margin, security margin, extreme loss rate, percentage of delivery quantity to traded quantity, etc. A particular stock can be compared with any other stock of the same sector on the basis of above factors. This is very useful to the investors as one can compare various stocks and choose a better one.