Getting started

The stock market is a dynamic place. At any given time, various factors affect stock prices and indices. Consider the following news headlines:

- RBI’s unexpected reporate hike surprises markets

- Oil prices nears decade high

- India’s GDP growth better than expected

These news stories could give a shock or a boost to your portfolio. In such cases, options and options strategies are used by:

- Investors to reduce their portfolio risk

- Traders to profit from various market conditions

Options provide a potential to make a profit whether the markets are moving up, down or sideways. However, one must remember that options are complex instruments, and option strategies can be even more complicated. If not used in a disciplined way, they could lead to severe capital losses.

For starters, in options trading, you could lose more than what you have invested. Let’s understand this with an example. If you purchase a share for ₹500, the maximum loss you can incur is the initial investment amount, i.e. ₹500. However, in certain naked options strategies, unlike hedged ones, the amount you can lose depends on the future rise in the stock, which is potentially limitless.

To solve such problems and to make options trading easier, Upstox has introduced

➡️link for UPSTOX account opening-➡️https://upstox.com/open-account/?f=QTG6 ➡️Important- first register and inform then only process TELEGRAM- https://t.me/sti001

Ready-made Option Strategies

- Choose from pre-curated option strategies

- Know profit probability, maximum profit & loss, and funds required for each strategy

- Trade with unique one-click entry and exit orders

Why should you use Ready-made Option Strategies?

Ready-made Option Strategies focus largely on multi-leg option strategies. These involve using two or more options in a single strategy and have a balanced risk profile. Here, losses as well as profits are capped, unlike single-leg or naked trades which are typically high risk-high return.

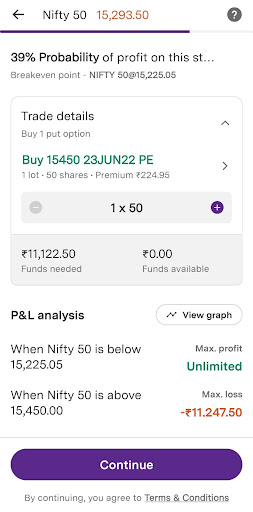

For example, if NIFTY is at 15,293 and a bearish trader chooses to trade in single-leg options, the trades could be like this:

- Buy 15,450 put at ₹225

OR

- Sell 15,400 call at ₹148

Trade details

In the ‘buy’ put trade, there is a risk of losing the entire premium paid if NIFTY closes at or above 15,450. Similarly, with the ‘sell’ call, losses could be potentially unlimited if NIFTY rises above 15,548.

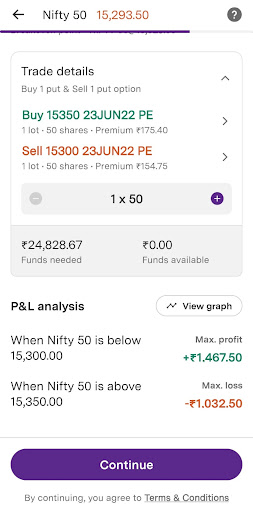

In contrast, Ready-made Option Strategies offer low-risk strategies such as a bear put spread to trade in a bearish market. This two-leg option strategy order could be as below:

- Buy 15,350 put at ₹175

AND

- Sell 15,300 put at ₹154

Trade details

In this strategy, the maximum profit could be ₹1,467 and the maximum loss could be ₹1,032. Such multi-leg strategies are not only safer, but also give immense control in the hands of the trader.

➡️link for Paytm Money account opening-➡️https://upstox.com/open-account/?f=QTG6 ➡️Important- first register and inform then only process whatsapp-7380842140

Comparison of option strategies

Here is a quick comparison of naked and multi-leg options. Clearly, multi-leg options score higher.Show 102550100 entriesSearch:

| Option strategy | Pros | Cons |

|---|

| Naked buy options | Risk limited to the amount of investment | Low probability of success as the underlying security needs to move in the expected direction and with high volatility |

| Naked sell options | Best probability of success as time-decay works in favour | Risk is potentially limitless, making it unsuitable for most traders Requires very high margin given the high risk |

| Multi-leg options | High probability of success due to lower initial cost Limits maximum risk in the trade due to the hedged position | The balance risk:reward profile may not be attractive to an aggressive trader Requires relatively higher margin than premium required for naked buy options |

Trading with our Ready-made Option strategies lets you choose pre-curated strategies in NIFTY and BANK NIFTY based on risk, profit probability, funds required to get actionable option trading ideas.

If you’re ready to take the next step, click here to know how to use Ready-made Option Strategies on Upstox.

Ready-made Option Strategies is free and available on the new Upstox app.