Introduction–

- Review of the company

- Strengths

- Annual Report

- IPO Important Date

Tapi Fruit IPO 2022 Processing Limited is a Manufacturer of Jelly Based Fruit Products such as Candied Crystallised and Glazed Fruits, Fruit Bar, Fruit Jellies, Fruit Jam & Fruit Leathers, Chutney & Sauces, Beverages, Fruit crush, Fruit Syrups and Nutraceutical products such as vitamin Gummies.The company was started in 1999 by its founder director Ghanshyam Lukhi as a Proprietorship firm namely Tapi Food Products Get More Earn More—.https://upstox.com/open-account/?f=4LB6Y8

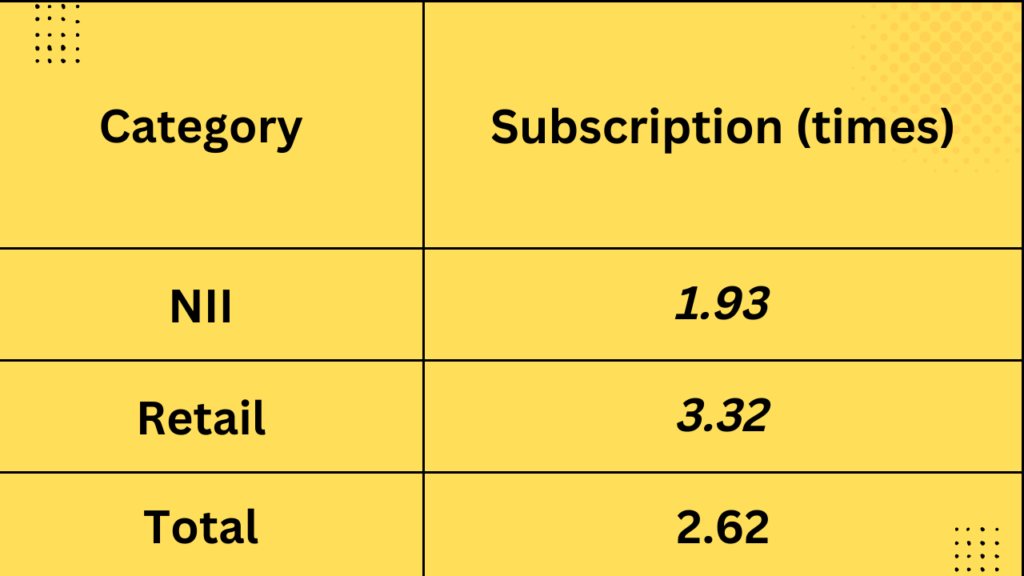

- Tapi Fruit IPO2022 Processing Subscription Status has started 12 September 2022and it is also being subscribed by QIB and NII & RII. let you know that the Tapi Fruit Processing IPO has opened on 12 September 2022 and closes on 14 September 2022. Which will be subscribed by 14 September 2022. Tapi Fruit Processing IPO is preparing to raise ₹5.21 Cr funds through its Fresh Issue and Offer For Sale, in which Fresh Issue of ₹5.21 Crores and Offer Sale of ₹- Crores. and Tapi Fruit Processing IPO Price Band is Fixed ₹48 per share. Check Tapi Fruit Processing IPO GMP Here.https://upstox.com/open-account/?f=4LB6Y8

2) The products of the company are manufactured in-house at the manufacturing facilities located in Pipodara village, Distt. Surat, Gujarat. Tapi Fruit Processing Limited has received several quality certifications and accreditations, including certification from the ISO 22000:2018 and the Food Safety and Standards Authority of India (FSSAI)https://allideass.com

3) The company have developed a large pan-India distribution network in the general trade and through our stockist, The company also supply in the modern trade segment. During the Financial Year ended March 31, 2022, we distributed our products across 28 states and Union Territories in India, through our widespread network of 60 super-stockist. The company products are manufactured in-house at our manufacturing facilities located in Pipodara village, Distt. Surat, Gujarat.

4) Tapi Fruit Processing has over the years leveraged our understanding of our target markets and consumer segments, product innovation capabilities, extensive distribution network, and strategically located manufacturing facilities, and has focused the marketing and promotional activities to strengthen their product brands and establish the brands across India.

Strengths :

- The company believes they are among the few organized players in the Candied Fruit & Fruit Jellies segment of confectionaries with a well-established distribution network.

- Wide spread and established sales and distribution

- Diversified Product Portfolio.

- Experienced promoter and management team.

Tapi Fruit IPO Bidding Detail–

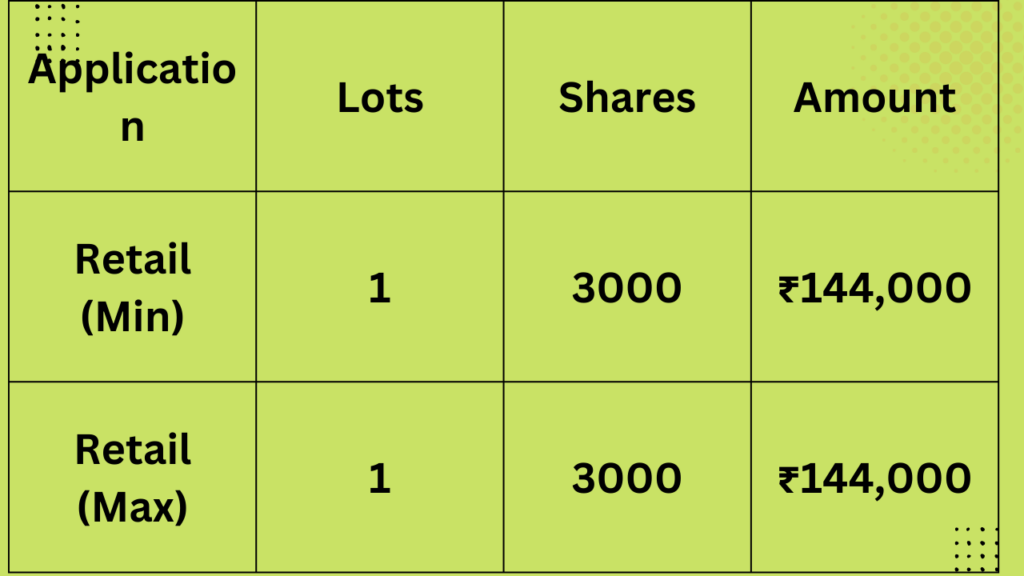

Tapi Fruit IPO 2022 Lot Size—

PROMOTER Holding —-

| Pre Issue Share Holding | 99.94% |

| Post Issue Share Holding |

Tapi Fruit Important Event–

| Tapi Fruit Date | Sep 12, 2022 to Sep 14, 2022 |

| Tapi Fruit Face Value | ₹10 per share |

| Tapi Fruit Processing IPO Price | ₹48 per share |

| Tapi Fruit Processing IPO Lot Size | 3000 Shares |

| Issue Size | 1,086,000 shares of ₹10 |

| Fresh Issue | 1,086,000 shares of ₹10 |

| Issue Type | Fixed Price Issue IPO |

| Listing At | NSE SME |

| NII (HNI) Shares Offered | 50% of the net offer |

| Retail Shares Offered | 50% of the net offer |

| Company Promoters | The Promoters of the Company are Ghanshyambhai Laljibhai Lukhi and Ashokkumar Laljibhai Lukhi. |

Tapi Fruit Timeline—

| Event | Date |

|---|---|

| Tapi Fruit Opening Date | Sep 12, 2022 |

| Tapi Fruit IPO Closing Date | Sep 14, 2022 |

| Basis of Allotment | Sep 19, 2022 |

| Initiation of Refunds | Sep 20, 2022 |

| Credit of Shares to Demat | Sep 21, 2022 |

| Tapi Fruit Listing Date | Sep 22, 2022 |

Objects of the issue —

i. Meeting incremental working capital requirements ii. Repayment/prepayment of certain borrowings availed by the Company iii. General corporate purposes

Company Annual Report—

| Period Ended | Total Assets | Total Revenue | Profit After Tax | Net Worth | Reserves and Surplus |

|---|---|---|---|---|---|

| 31-Mar-20 | 589.18 | 1145.69 | -0.86 | 17.36 | -7.64 |

| 31-Mar-21 | 737.4 | 1312.5 | 10.06 | 27.42 | 2.42 |

| 31-Mar-22 | 802.88 | 1522.09 | 15.6 | 43.02 | 18.02 |

| Amount in ₹ Lakhs |

| Earning Per Share (EPS): | ₹1.66 per Equity Share |

| Price/Earning P/E Ratio: | N/A |

| Return on Net Worth (RoNW): | 36.26% |

| Net Asset Value (NAV): | ₹4.56 per Equity Share |

Tapi Fruit ipo 2022 Company Promoters—

- Ghanshyambhai Laljibhai Lukhi

- Ashokkumar Laljibhai Lukhi